E-Commerce Fraud Prevention

E-commerce fraud happens when criminals interfere with online transactions to steal money or gain unfair financial benefits. This type of fraud can target customers, merchants, or both. Here are some common types of e-commerce fraud:

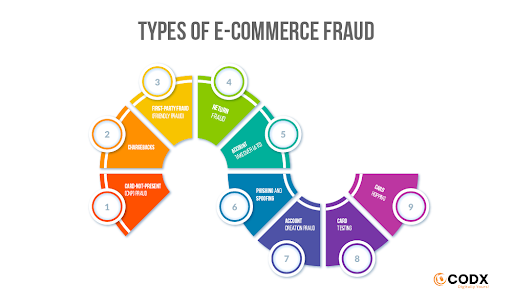

Types of E-Commerce Fraud

- Card-Not-Present (CNP) Fraud

Fraudsters use stolen credit card information to make online purchases without the physical card. - Chargebacks

Customers dispute charges, leading to reversed payments and financial loss for merchants. - First-Party Fraud (Friendly Fraud)

Legitimate customers falsely claim transactions were unauthorized to get refunds while keeping the goods or services. - Return Fraud

Customers return used or damaged items, claiming they are defective to get refunds or replacements. - Account Takeover (ATO)

Criminals gain unauthorized access to customer accounts, stealing information or making purchases using saved payment details. - Phishing and Spoofing

Fraudsters trick customers into revealing personal or financial details through fake emails or websites. - Account Creation Fraud

Fraudsters create fake accounts to exploit promotions, discounts, or referral programs, causing financial loss to merchants. - Card Testing

Fraudsters make small purchases to check if stolen credit cards are active before using them for larger transactions. - Card Hopping

After validating stolen credit cards, fraudsters use them for larger unauthorized purchases.

Best Practices for Preventing E-Commerce Fraud

Businesses and consumers must take proactive steps to reduce the risk of fraud. Here are some key measures:

- Use a Secure Website

Make sure your website is HTTPS-enabled. This ensures secure data encryption during transactions. - Keep Fraud Prevention Software Updated

Regularly update software to stay ahead of new fraud tactics. This software helps detect suspicious activity and minimize risks. - Adhere to PCI Standards

Follow the Payment Card Industry Data Security Standard (PCI DSS) to securely handle and store credit card information. - Conduct Regular Security Audits

Perform audits to find and fix security vulnerabilities. Check for up-to-date security certificates, compliance status, and software updates. - Invest in Address Verification Services (AVS)

AVS checks whether the billing address matches the one on file with the card issuer. It reduces the risk of fraud. - Require Card Authentication Protocols

Ask for Card Verification Value (CVV) codes during transactions to confirm that the buyer physically has the card. - Enforce Strict Account Access Rules

Use strong passwords and multi-factor authentication (MFA) to ensure only authorized users can access accounts. - Use AI and Machine Learning

AI and machine learning can detect new fraud methods, reduce human error, and automate fraud prevention.

E-Commerce Fraud Prevention Tools

To protect their businesses, merchants should use these key tools:

- Fraud Detection Software

Real-time analysis of transactions helps detect suspicious activity and reduce fraud risks. - Address Verification Service (AVS)

AVS checks the billing address during checkout to confirm it matches the one on file with the card issuer. - Card Verification Code (CVC) Checks

Requiring CVC codes during payment helps verify the cardholder’s identity, adding an extra layer of security. - 3D Secure Authentication

3D Secure, such as Verified by Visa or Mastercard SecureCode, adds an extra authentication step, shifting liability for fraud to the card issuer. - Device Recognition Solutions

These tools track device details like IP address and browser type to detect unusual activity or potential fraud.

Conclusion

In today’s eCommerce world, fraudsters are always finding new ways to exploit weaknesses and scam merchants. However, by staying informed, using strong fraud prevention strategies, and adopting Identity and Access Management services, merchants can protect their businesses from financial losses and reputational harm. The key to success is being proactive, continuously monitoring transactions, and adjusting to new threats. Stay alert, stay secure, and ensure your online sales continue to grow in a safe and trusted environment.

As an award-winning agency, Codx takes pride not just in the digital solutions we offer our partners but also in our advisory expertise.

We are here to help you create the perfect plan for your exciting new business venture. Whether you are just starting out or considering the idea, we’ve got you covered.

Contact us today and let’s discuss how we can develop a customized metaverse strategy to position your brand for success in the e-commerce revolution!

Book your free consultation now.

- 58 views

- 0 Comment